There are two ways you can borrow a payday loan online: one is through a payday direct lender and the other is through a matching service.

What Is the Difference Between Payday Direct Lenders and Matching Services?

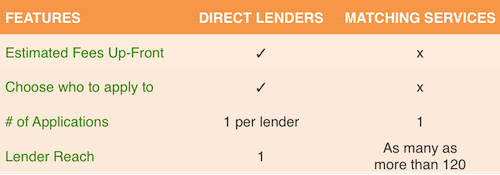

The key difference is that payday direct lenders are responsible for underwriting, funding, and servicing your payday loan whereas payday loan matching services only collect your information, screen it, and then send it to lenders. In other words, payday matching services act as the middle person between you and the lender that will be servicing your payday loan.

Payday Direct Lender vs. Matching Services Summary

Payday Direct Lenders

In general, payday direct lenders provide pricing estimates before you apply so you know what your costs will be beforehand. Some of our most popular payday direct lenders include CashNetUSA, Ace Cash Express, and Check City. The above lenders are state-licensed lenders and our top picks by Doshound.

Payday Matching Services

Payday matching services connect you to a network of payday loan lenders, including some offline payday loan lenders (or lenders who have no online presence other than through a payday loan network). The main benefit of payday matching services is convenience, as you only have to fill out one application and the matching service will send your application to multiple lenders. If the first lender rejects you, the matching service will send it to the next lender on its list until it finds one that accepts you or it has no more lenders. If the matching service finds one that accepts you, it will send you to that lender’s website, directly to the loan agreement form with loan terms. If it does not find a lender, then you will be notified that you have been denied. This all happens within a matter of seconds. The benefit of this process is that it eliminates applying to multiple payday lenders individually until you are approved for one.

Before you proceed with a matching service here are some things to consider:

- Fees are only provided after you are matched with a lender. Any fees advertised on a matching service site should be looked at with caution, as the actual fees will vary.

- These services do not provide a list of lenders in their network. Instead, you just apply to the network meaning you can’t choose which lenders to whom you want to apply.

- The first lender that is matched will be the option available to you. In other words matching services do not try and find the best lender for you but the first one that will take you.

If you choose to use a matching service, we suggest you research and compare pricing for the lender with whom you’ve been approved lender to determine if your loan is really the best option for you. You can use sites like the Better Business Bureau to check for complaints. You can also check back on our payday lender reviews. If the lender has not been reviewed, please send us an email at moc.dnuohyadyapeht@kcabdeef with a link to the lender and we will review it.