Payday loans are designed to meet short-term, emergency cash needs. They were created to get cash into a borrower’s hands as quickly as possible. The application process is streamlined with minimal documentation. The loan is due for repayment on the next payday.

Payday loans are not a good choice for longer-term borrowing needs. Rolling over or renewing payday loans greatly increases costs and often times alternative options provide cheaper funding. Payday loans can be cheaper when compared to bank overdraft fees and late penalty fees when they are paid off at the next payday but are more expensive than credit card advances or bank loans so if either of the latter options are available they would be a preferred pick for us.

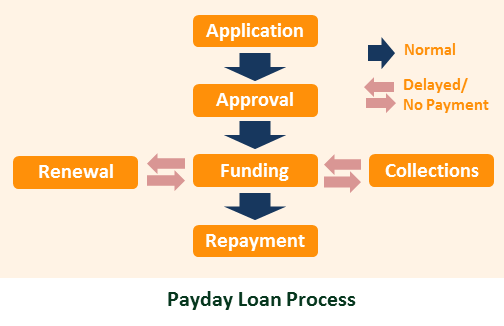

The basic steps for an online payday loan are as follow:

A. Application

The application is designed to identify you, to verify how you get paid, and to connect the lender to your checking account. For ID verification, general personal information like your name, date of birth, driver's license, and social security numbers are required. For payday information, applications ask for employer name, and paycheck amount, payday, and frequency. For checking account information, they ask for your bank routing number and checking account number. Some applications ask about homeownership and direct deposit and for references. All of this is done online.

B. Loan Approval

Loan approval generally happens within seconds. If your data does not match the ID verification databases, lenders may ask for supporting documents like pay stubs before they can approve you.

C. Funding

Once approved, the lender will direct deposit funds into your checking account usually by the next business day.

D. Repayment

On your next payday, the lender automatically withdraws funds from your checking account to repay the loan plus fees. In most cases, this happens without additional notice to you, so make sure you have adequate funds in your account to repay your loan. See Renewal below if you are unable to keep adequate funds in your account.

E. Renewal

Many times, the lender provides an option to renew if you notify the lender a couple of days before your next payday. If approved, the lender will only withdraw the fees owed and not the principal amount of the loan. Then, on the following payday, the principal and ADDITIONAL fees will be withdrawn. There is a limited number of times that a payday loan can be renewed. This is often mandated by law and beyond the control of lenders. The number of renewals vary, but is generally around 3-5 times per loan.

We have recently read in the news of stories of lenders that automatically renew your loan so they can charge additional fees. When taking out a loan make sure you review your terms and contact your lender if you do not want to renew.

F. Collections

If you don’t have enough money in your checking account, the lender will continue to try to withdraw money from your account until your full principal and fees are paid. Additional fees, on top of fees your bank may charge you for overdrafts, will continue to be charged if your principal is not paid. These fees add up very quickly so be very careful to pay your loan off in time or to alert your bank and lender if you are unable to pay. If the lender is unable to collect its fees and principal, it may sell your loan to a collection agency that will continue to try to collect money from you.