NOTE: Wells Fargo launched this product in early 2012 and stopped offering this product in May of 2014 based on pressure from media, advocacy groups, and regulators. This is an unfortunate outcome as it decreases options for consumers. The Wells Fargo product was one of the best with the lowest fees and highly regulated collections.

What follows is our original post from May of 2012.

Originally Posted on May 2012

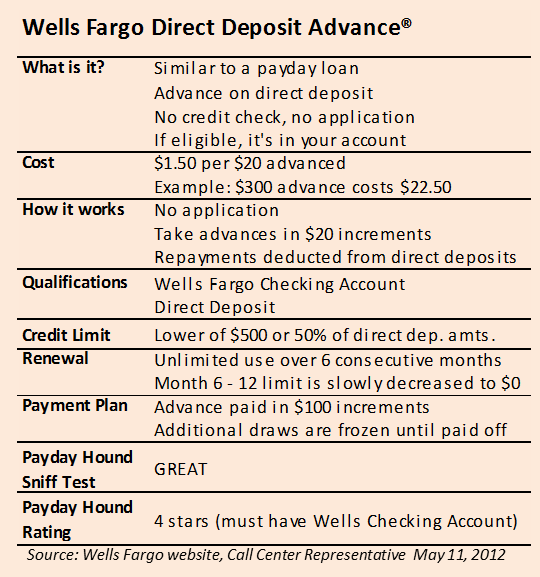

Wells Fargo recently entered the payday lending space with a new product called Direct Deposit Advance. Doshound believes it is an aggressively priced product and a very good option to consider when looking at short-term, emergency funding options such as payday loans. It is only available to Wells Fargo customers.

The pricing for the advance is $1.50 for every $20 advanced.

For a $300 advance, this is $22.50. Since it's only for existing Wells Fargo account holders, there is no application or sign up process. If you have a qualified Wells Fargo checking account, it's already in your account and you can just choose to take an advance from it. The Wells Fargo team is very careful at making sure you realize this product is designed for short-term, emergency funding.

Here's a run down of the product:

- Qualifications: A qualified Wells Fargo checking account in good standing that receives $200 or more in direct deposits a month.

- Qualified Wells Checking account: There’s fine print here, but generally, if you have a basic checking account, you are good to go. The accounts that do not qualify include student and teen accounts. Other excluded accounts include Premier and Private Banking accounts (stinks for these guys).

- Credit Limit: 50% of average direct deposits over a statement cycle or up to $500.

- Usage: $20 increments up to your credit limit as often as needed. Fees are not counted against your credit limit.

- Repayment: Deducted automatically from your account whenever a direct deposit arrives. There is also a mail option that has a $100 set-up fee with a $35 late fee.

- Renewal: The credit limit is maintained for six statement cycles (about six months) during which time you can use it as often as you like. After six cycles the credit limit is reduced proportionately each cycle until it is to $0 by month 12. After one statement cycle, you can then re-apply. If you don’t take any advance and keep your balance to $0 for one cycle at any time during the first six cycles, the clock resets (i.e. you have another six months until the credit limit is decreased).

- Available States: Alaska, Arkansas, Arizona, California, Colorado, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, New Mexico, Nevada, North Dakota, Ohio, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, and Wyoming.

The product also has a neat repayment plan option. After three statements of consecutive months of usage, you can sign up for a repayment plan. This basically gives you a free option to turn your line into an installment loan (See our Payday Loan versus Installment Loan analysis). To use this, you must have drawn down at least $300. Payments will be $100 from each direct deposit until the amount is paid off. While using the payment plan, no other advances can be made.

This account does require you to have a Wells Fargo checking account. If you do not have a Wells account, you need $100 to open an account, which if you need an advance you probably don’t have. In that case you will need to try someone like CashNetUSA, Ace Cash Advance, or Check City.

In calculating our costs, we did not include any fees associated with owning a Wells Fargo account. In most cases, if you are doing direct deposit, your checking account is free. There are other fees associated with a Wells checking account, such as ATM fees, but we feel these fees are related to another service not necessarily associated with this one and so did not include those prices. We also did not include the mail-in payment option. We focus on online options and feel most of our users will not opt-in to this option. The pricing of this product is aggressive and is a great option for short-term, emergency needs. A future post will look into how Wells Fargo is able to charge this rate while others are charging higher rates.

Doshound really likes this product for people who already have a Wells Fargo checking account in a qualified state. And apparently so do many others. The very friendly and helpful representatives said this product is so popular on Fridays that Fridays are informally known within their team as Direct Advance Fridays.