Direct payday loan lenders make are companies that actually make payday loans. Understanding the payday loan process and other players in the process will help to explain this better.

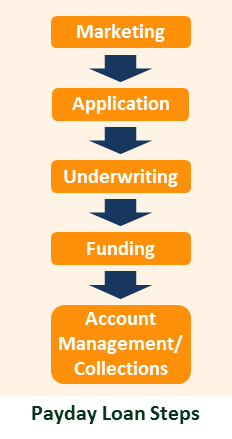

The basic steps for making a payday loan are,

- Marketing the Loan. Finding people that want and can qualify a loan.

- Getting an Application. Getting the applicants information.

- Underwriting. Deciding yes or no to making a payday loan.

- Funding. Having the money to lend to the borrower.

- Account Management and Collections. Getting your cash into your checking account, managing your account, calculating fees, call centers and collecting payment.

Direct Payday Loan Lenders generally manage all the steps listed above. Sometimes they do the entire process themselves and other times they partner with companies to help them. CashNetUSA, Check City, and ACE Cash Express are examples of direct payday loan lenders. They manage all the steps of the above process. You can apply directly for a loan from any of them. These two companies also work with other partners to help them with the different steps. For example, some direct payday loan lenders work with networks that help to market and/or gather applications for them. These networks act as a matching service. A network may work with multiple direct payday loan lenders directing borrowers to their website’s or even taking applications and then forwarding qualified applications on to direct payday loan lenders. For example, The Payday Hound works with T3 Leads and RoundSky. When you apply for a payday loan from our site your application will be matched different direct payday loan lenders via direct relationships we have with lenders and by going through these two networks.

Underwriting is generally done by the direct payday loan lenders themselves. This involves setting loan pricing and acceptance criteria. Usually, this step involves statistical analysis to understand what attributes in a loan application identify people that will pay them back. The fourth step is funding the loan. In order to give you money, the payday loan lender must have money to give. Sometimes payday loan lenders take out bank loans to have money to lend to you. For example, Wells Fargo makes loans to some payday loan companies. The payday loan company then lends the money to you but if you don’t pay the loan back then the payday loan company must use their own money to pay back the bank. The final step is the operations and collections. This involves the actual mechanics of transferring money into your checking account as well as making sure you pay the loan back. Sometimes direct payday loan companies will outsource this step to companies that have the software and staff designed to do this.

The advantage of working with a direct payday loan lender is you know exactly to whom you are applying. In addition, they generally provide you a list of rates and terms before you even apply for a loan. The disadvantage of applying to direct payday loan lenders is that you need to apply directly to each one individually. So if you are rejected by one lender you must fill out another application each time you apply to another lender. When you apply through a network you only need one application. The disadvantage is that you do not get to see your rate or terms until after you have been approved. But remember you never have to accept a loan and never should accept a loan, even if approved, until you have reviewed, understood, and agreed to the loan terms.